The founder of TCS – F.C Kohli – and I were once in an elevator at the Air INDIA building in Mumbai in 1999. It was just the two of us. I was a new trainee and he was the Deputy Chairman. He asked me some question along the lines of “How are you doing son?” and all I can remember is fumbling to answer him and my mind going empty. He smiled, wished me a good day and walked off the elevator and it took me another ten minutes to get my bearings right 🙂

It is not that I was low on confidence generally. Throughout my MBA – just before joining TCS – I used to challenge my professors and could hold my own in fierce debates. I had no difficulties engaging with other TCS leaders that I had met during my training. But when an imposing senior leader greeted me – I didn’t know what to do.

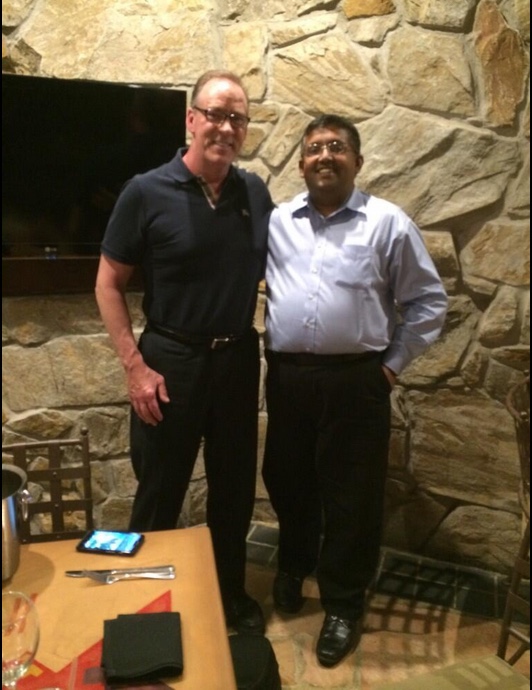

I had a similar fumble a decade later when I made my first ever presentation in front of a CEO – my role being an expert consultant. My boss at the time – John Leffler ( the guy standing with me in the photo above) realised the problem in a second and swiftly intervened and saved the day. Again – I had no issues dealing with the CIO of that company or the assorted VPs in the business till that time. I got a lot of coaching from my boss and other Partners after that incident and I got better.

I have seen this happen first hand when I meet with my junior colleagues – some of them totally freeze. Today morning one of them reached out to me and asked for some tips on how they can do better. I figured it might be helpful to jot down my thoughts here.

1. Know what’s different with senior executives compared to other managers in the hierarchy

They are only human like the rest of us – but they generally have limited time. They generally can zoom in and out of issues – but they might not know the specifics of any given issue like you do. Their job is to make a few highly impactful decisions – not hundreds of less impactful decisions. They are very good at prioritising what they work on – so that they have the time and energy to solve the big problems. When they look impatient – it is usually because they do not share the same context as you do. There is a high chance that they are smart enough to see the problem and the solutions quickly – but you will be doing them a favour if they don’t have to guess and you give them solutions to choose from and can answer their questions.

2. Answer questions directly to win their trust

What do you expect the sales to be this quarter? A great answer is X million dollars plus or minus 5% and waiting for them to ask what will drive the plus or minus. They know a lot of variables are at play and they expect you to abstract it away and give them a net-net answer. A useless – though totally accurate answer – would be “it depends on a lot of factors”. It is totally fine to highlight what could cause a big swing by saying something like “XYZ client might get a new CFO and that could slow down approvals and that could reduce our sales by 40%”.

3. Listen carefully, observe body language and clarify the questions before answering

You don’t need to do most of the talking in most meetings. Listen to understand and take cues from their tone, their facial expression and so on before you answer. Don’t feel compelled to answer quickly if you need thinking time – you can buy time by asking follow on questions, or you can tell them that you need time to find an answer and then give them a commitment on when you will respond and get their concurrence. Thoughtful and high quality answers are what helps the exec. Sometimes they need a good enough answer – if that’s the case, you have to give them an answer and put the minimum caveats in place. Don’t make up an answer – it’s always better to not mislead them.

4. Get to know them and find some common ground

Study their past communications – any speeches, interviews etc . Talk to people who know them more than you do. I have always found it a good practice to get to know their admins and chiefs of staff personally. Once you know a bit about their style and ways of working – you can tailor your conversation much more effectively. This is not always possible – but when it’s possible, not making use of it is inexcusable. Most human beings have something in common with you – those are great conversation starters and help build trust.

5. Appear confident

Remember that on any specific issue you are going to discuss – there is a good chance that you know the details way more than the exec does. In fact the executive expects you to be the expert! So go into the conversation with that confidence. Set the context very briefly and ask if they have different expectations than the one you think. The chance of blanking out your mind is the highest when you start the talk. So it might be a good idea to practice the opening part a few times . A solid start will generally create enough momentum to carry you through successfully

6. Build the relationship naturally

Communication with execs gets a lot easier and more effective once you know them. Don’t think of those meetings as transactions – use them to build a relationship. Such a great relationship with senior leaders is key to your own career success. The key is to let it evolve naturally without forcing it. It’s totally fair game to ask an exec for time to get introduced – most leaders love hearing from their team. You may not get a meeting right away, but there is a high chance you will get it if you stay patient and persistent.